421a tax abatement meaning

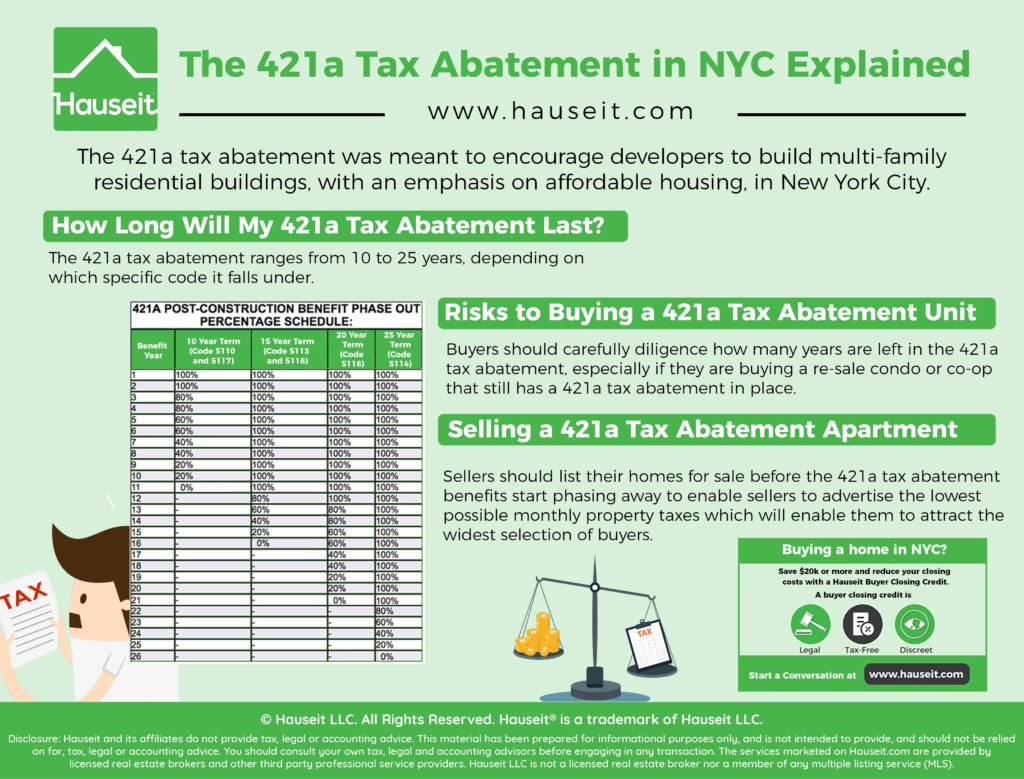

The program can be beneficial if you bought a home in the 421a program and the exemption is about to expire. As currently written the program also focuses on promoting affordable housing in the most densely populated areas of New York City.

Nyc Real Estate Taxes 421a Tax Abatements And Manhattan Property Tax

The exemption is granted for any buildings that add.

. The difference between the J-51 and 421-a abatement is. If it is newly constructed the abatement is known as a 421-a tax abatement. Hochul has acknowledged the lack of low-income housing development and proposed replacing 421a with a modified though similar tax abatement scheme known as 485w like 421a it is named for its location in the property tax code.

In New York State a 421a Tax Abatement is a tax exemption for real estate developers who build multi-family residential buildings in New York City. The 421-a tax exemption is a property tax exemption in the US. Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

TaxAct helps you maximize your deductions with easy to use tax filing software. State of New York that is given to real-estate developers for building new multi-family residential housing buildings in New York City. After the tax exemption was suspended in 2016 the New York State Legislature extended the 421-a program in April of 2017 with retroactive coverage to 2016 so that the.

The owners of the new property pay significantly lower taxes for the first ten years of the buildings life. The 421a tax abatement program remains in limbo and its future hinges on one crucial question. In some buildings the abatements could last up to 35 years.

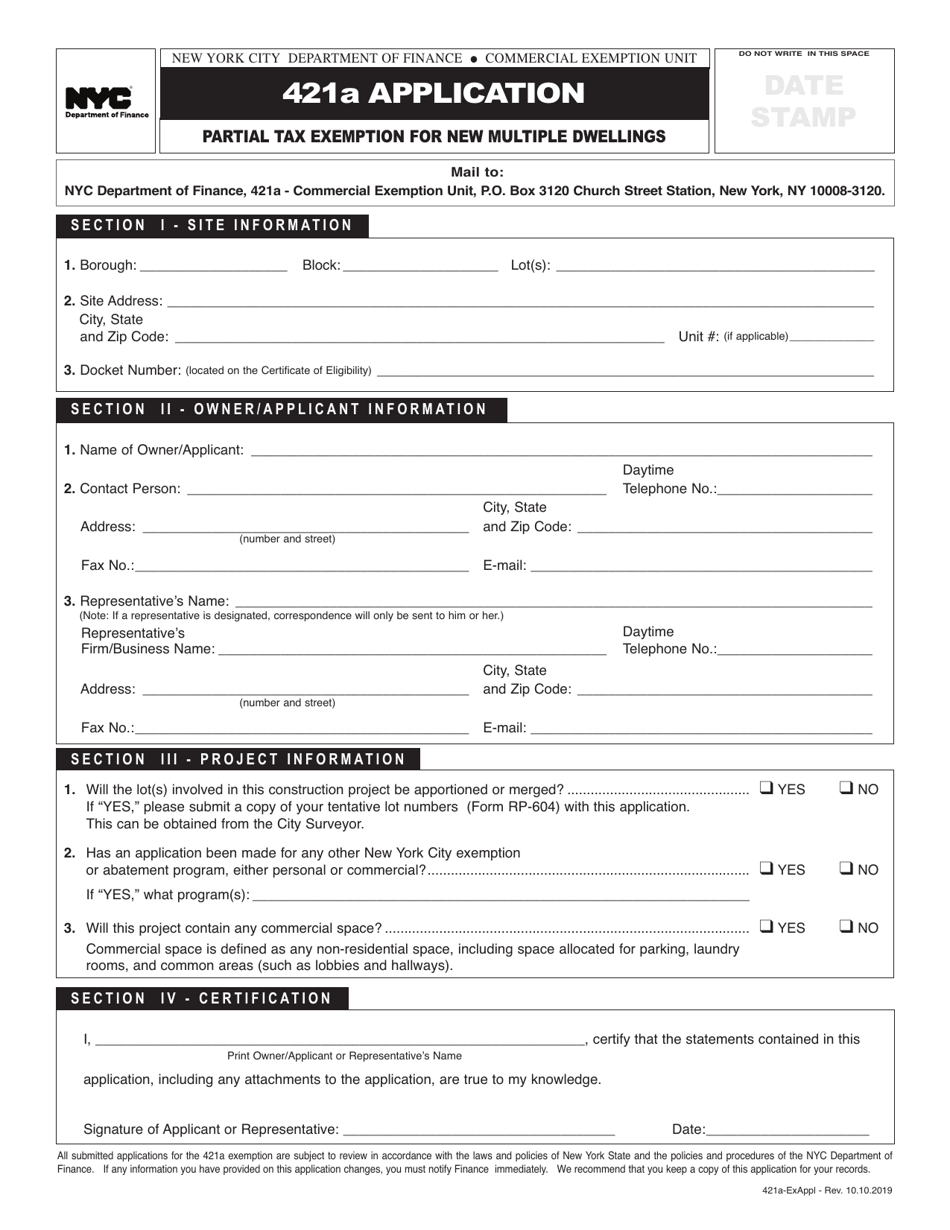

The 421-a tax abatement was created in 1971 to encourage the development of underutilized or unused land by significantly reducing property taxes on newly developed land for a set period of time. FYI affordable housing types like Mitchell Lama or HDFC units do not qualify. The full 421a tax abatement application package includes DHCR rent registration the restrictive declaration and other documents.

HPD accepts a 421a Certificate of Eligibility Application after marketing of affordable units commences and a temporary or permanent certificate of occupancy is issued for the property. The 421-A Tax Abatement Program was developed to promote the construction of multi-family dwellings by providing tax relief benefits to the owners of the property. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

On February 7 2019 the notice was sent to 3990 properties owner that they were not in compliance with the 421-a programs requirements. If the building was rehabilitated or converted from another use the abatement is known as a J-51 tax abatement. Established a new 421-a tax exemption program for any project that commenced construction between January 1 2016 and June 15 2019 and was completed on or before June 15 2023 New Program and provided that the New Program would not come into effect until representatives of residential real estate developers and construction labor unions signed a.

The 421-a 1-15 will suspend for 202021 tax year if fail to submit the Final certificate of Eligibility. The program was established in 1971 and has been closed re-opened and reorganized several times. During the time period thousands of New Yorkers were moving upstate or to the suburbs and City officials feared a decline in residential development.

Should City Hall mandate prevailing construction wages. The exemption also applies to buildings that add new residential units. Ad The simple easy and 100 accurate way to file taxes online.

However housing advocates have long felt that 421a was overly generous to developers and that it generates the wrong kind of housing. Its a city-run property tax abatement program for co-ops and condos designed to ease the burden of qualified units taxes. Click below for the listing.

The 421-a Tax Incentive program is a partial real estate tax exemption for new construction of housing. Ad Over 85 million taxes filed with TaxAct. The tax exemption was originally developed by the city and state in 1971 when New York Citys economy was inching toward collapse and both real estate development and tax revenues were falling.

The proposal has the support of Mayor Eric Adams influential labor unions and the real estate industry. Start filing for free online now.

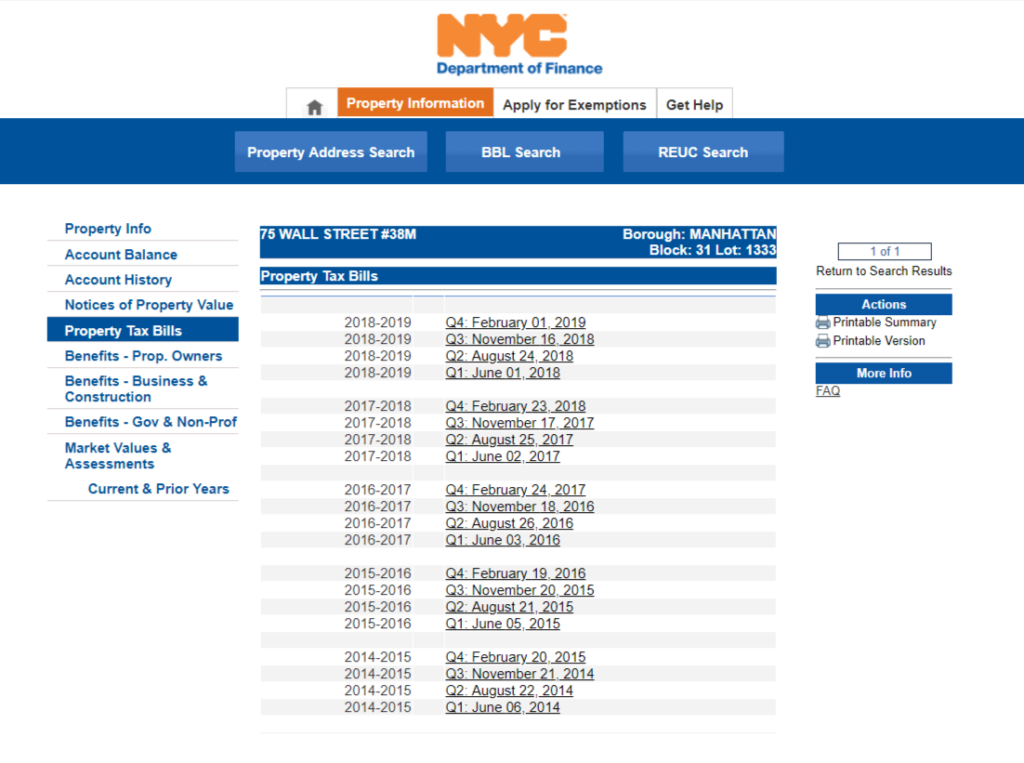

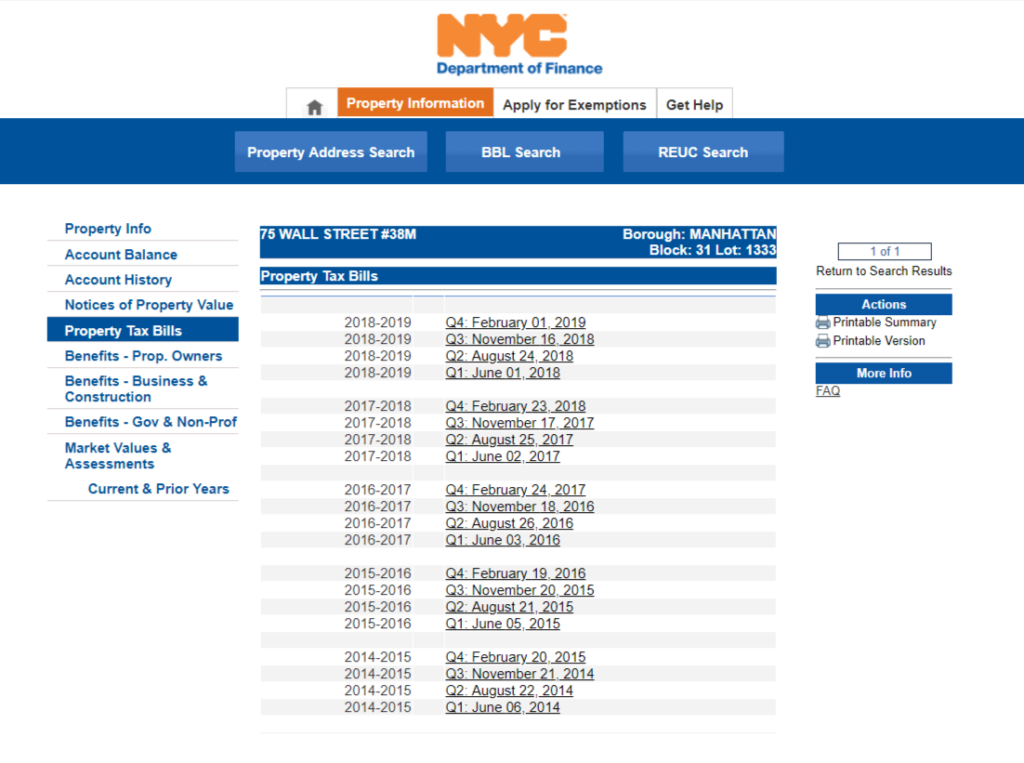

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Tax Abatement Nyc Guide 421a J 51 And More

The 421a Tax Abatement In Nyc Explained Hauseit

Nyc Tax Abatements Guide 421a J 51 And More Makingnyc Home

Understanding Rebny S New 421 A Tax Exemption Proposal Association For Neighborhood And Housing Development

What Is A 421a Tax Abatement In Nyc Streeteasy

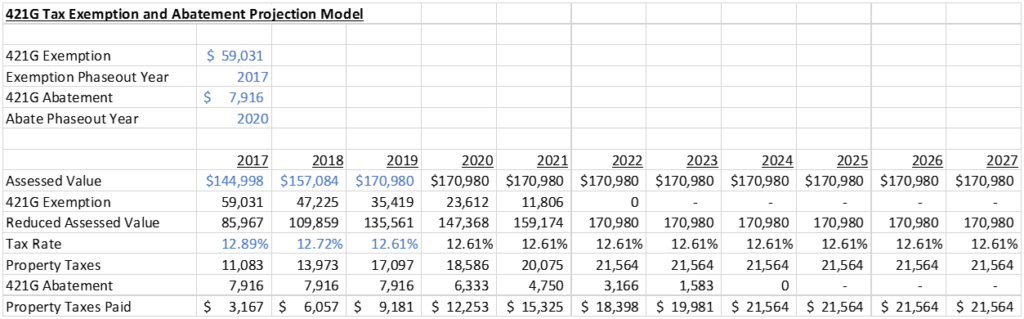

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

The 421a Tax Abatement In Nyc Explained Hauseit

New York City 421a Partial Tax Exemption For New Multiple Dwellings Application Download Printable Pdf Templateroller

Tax Abatement Nyc Guide 421a J 51 And More

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

421a Tax Abatement Archives Nestapple

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo