nh food tax rate

The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. New Hampshires sales tax rates for commonly exempted categories are listed below.

Historical New Hampshire Tax Policy Information Ballotpedia

Weare Hazard Mitigation Committee.

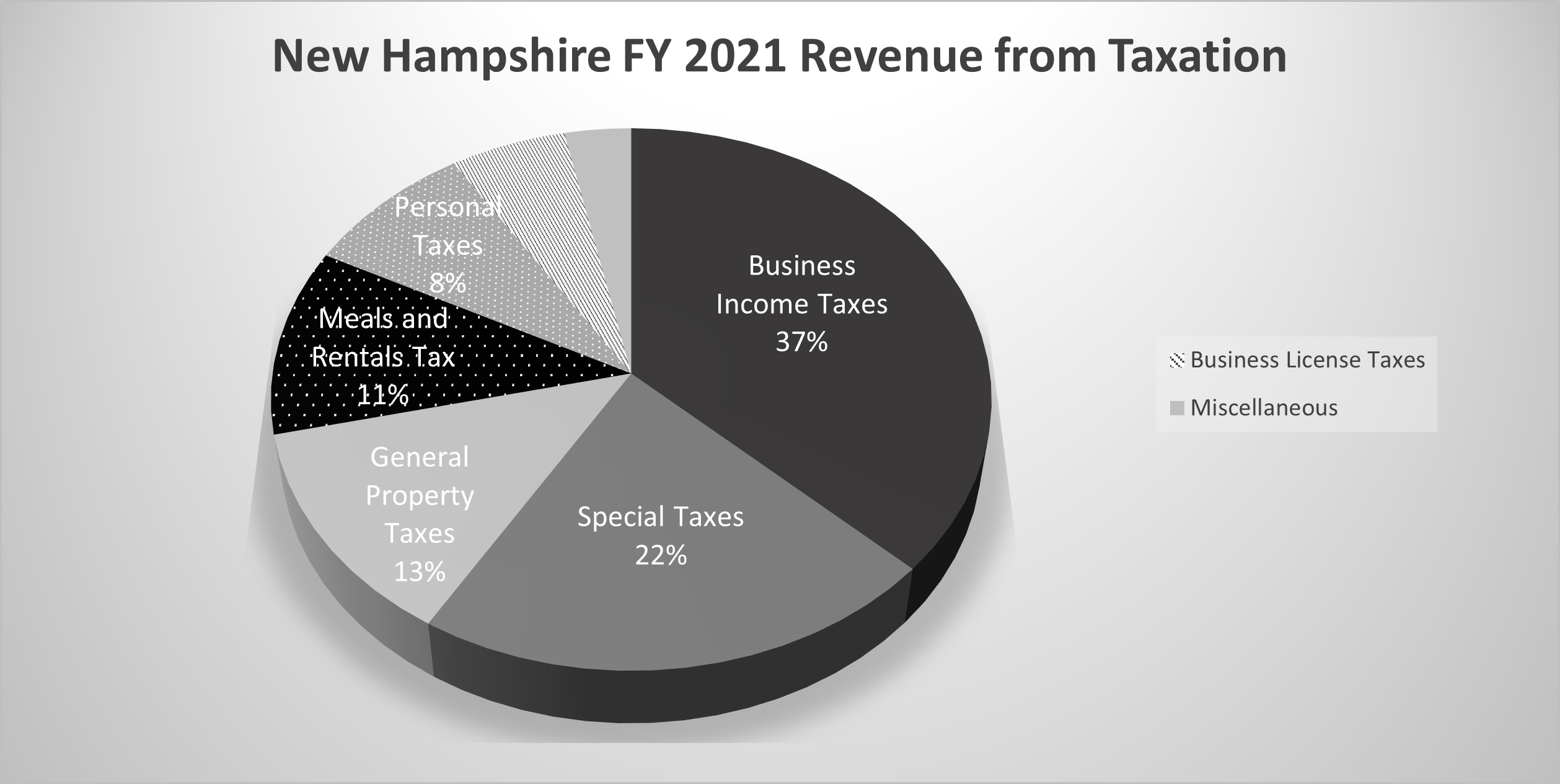

. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. 45 rows Annual Tax Rate Determination Letters mailed by September 2 2022 for the tax. 2021 Tax Rate Comparison.

Nh Food Tax Calculator. 2131 2848 2696 2723 2601 2510 947 Revaluation Year Values Increased 786 838 882 911 966. The state does tax income from interest and.

Nh Food Tax Calculator. New hampshire cities andor municipalities dont have a city sales tax. The state general sales tax rate of new hampshire is 0.

A 9 tax is assessed upon patrons of hotels. Some rates might be different in Portsmouth. Nh Food Tax Calculator.

Nh Food Tax Calculator. This marginal tax rate. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Your average tax rate is 1198 and your marginal tax rate is 22. Prepared Food is subject to special sales tax rates under New Hampshire law. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is. All documents have been saved in Portable Document Format unless otherwise. For additional assistance please call the Department of Revenue Administration at 603.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. 2021 2020 2019 2018 2017 2016. 2021 Tax Rate Computation.

A 9 tax is also assessed on motor. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. Nh Food Tax Calculator.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is.

A 9 tax is also assessed on motor vehicle rentals. Hebron has the lowest property tax rate in New Hampshire with a tax rate of 652 while Claremont has the highest property tax rate in New Hampshire with a tax rate of 4098. Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090.

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

States With The Highest Lowest Tax Rates

New Hampshire Cuts Tax On Rooms Meals To 8 5

New Hampshire Income Tax Calculator Smartasset

Time To Cap Commissions On Nh Meals And Rooms Tax

Sales Tax Laws By State Ultimate Guide For Business Owners

State Tax Rates Mycareersalary Com

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

How Are Groceries Candy And Soda Taxed In Your State

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

Meals Rooms Rentals Tax Data Nh Department Of Revenue Administration

New Hampshire Income Tax Calculator Smartasset

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

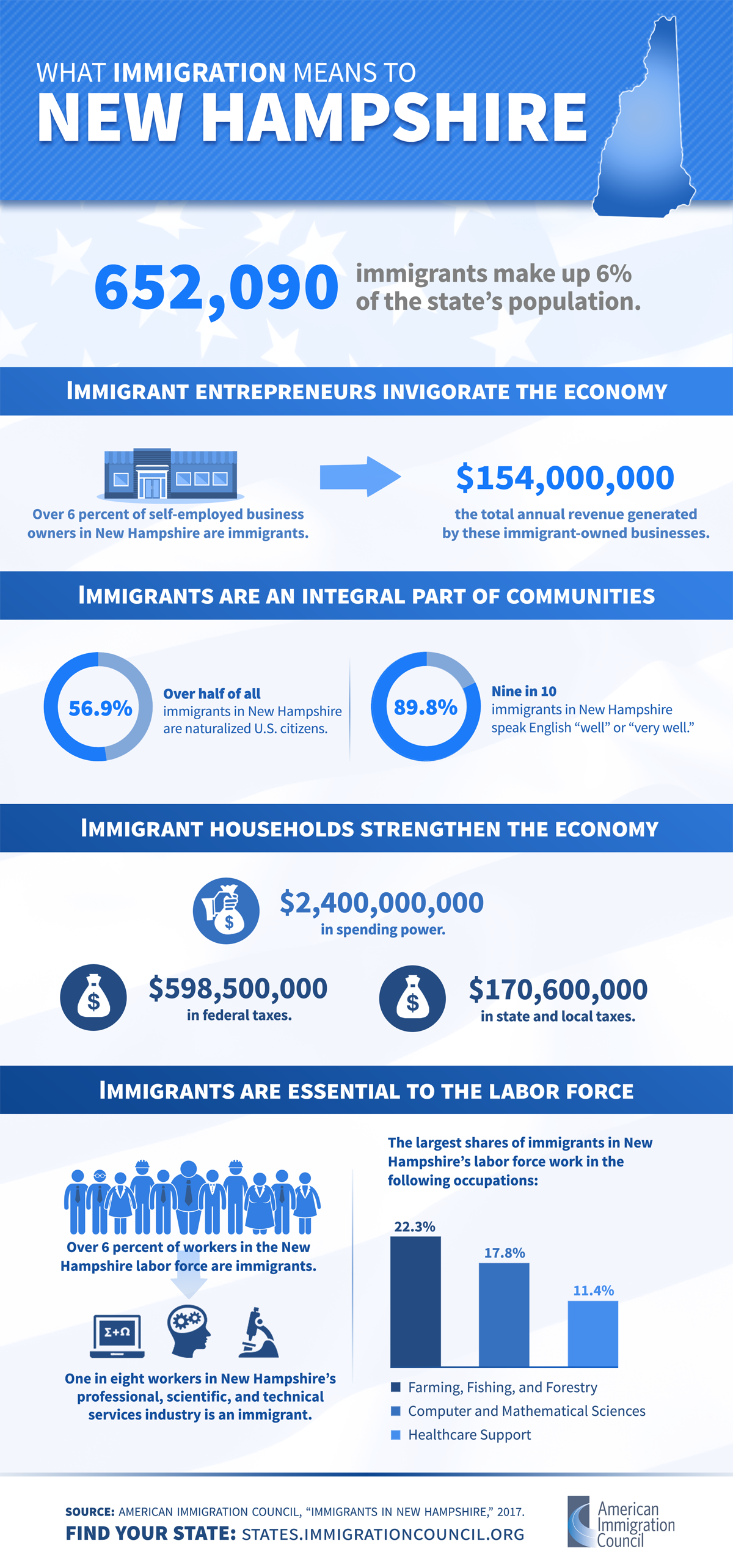

Immigrants In New Hampshire American Immigration Council

General Sales Taxes And Gross Receipts Taxes Urban Institute